Email

Canada's waning competitiveness on capital gains taxes, and insights to guide our immigration policy

| From | Fraser Institute <[email protected]> |

| Subject | Canada's waning competitiveness on capital gains taxes, and insights to guide our immigration policy |

| Date | January 18, 2025 6:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

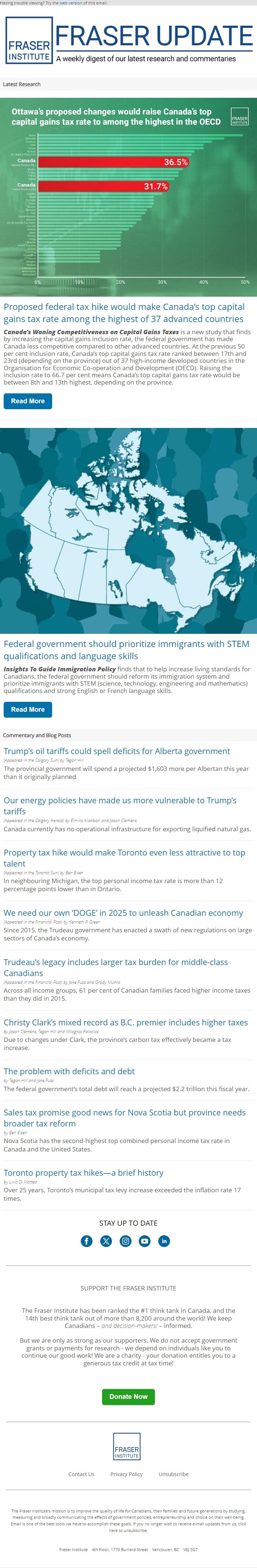

Having trouble viewing? Try the web version [link removed] of this email. Latest Research Proposed federal tax hike would make Canada’s top capital gains tax rate among the highest of 37 advanced countries [[link removed]]

Canada’s Waning Competitiveness on Capital Gains Taxes is a new study that finds by increasing the capital gains inclusion rate, the federal government has made Canada less competitive compared to other advanced countries. At the previous 50 per cent inclusion rate, Canada’s top capital gains tax rate ranked between 17th and 23rd (depending on the province) out of 37 high-income developed countries in the Organisation for Economic Co-operation and Development (OECD). Raising the inclusion rate to 66.7 per cent means Canada’s top capital gains tax rate would be between 8th and 13th highest, depending on the province.

Read More [[link removed]] Federal government should prioritize immigrants with STEM qualifications and language skills [[link removed]]

Insights To Guide Immigration Policy finds that to help increase living standards for Canadians, the federal government should reform its immigration system and prioritize immigrants with STEM (science, technology, engineering and mathematics) qualifications and strong English or French language skills.

Read More [[link removed]] Commentary and Blog Posts Trump’s oil tariffs could spell deficits for Alberta government [[link removed]] (Appeared in the Calgary Sun) by Tegan Hill

The provincial government will spend a projected $1,603 more per Albertan this year than it originally planned.

Our energy policies have made us more vulnerable to Trump’s tariffs [[link removed]] (Appeared in the Calgary Herald) by Elmira Aliakbari and Jason Clemens

Canada currently has no operational infrastructure for exporting liquified natural gas.

Property tax hike would make Toronto even less attractive to top talent [[link removed]] (Appeared in the Toronto Sun) by Ben Eisen

In neighbouring Michigan, the top personal income tax rate is more than 12 percentage points lower than in Ontario.

We need our own ‘DOGE’ in 2025 to unleash Canadian economy [[link removed]] (Appeared in the Financial Post) by Kenneth P. Green

Since 2015, the Trudeau government has enacted a swath of new regulations on large sectors of Canada’s economy.

Trudeau’s legacy includes larger tax burden for middle-class Canadians [[link removed]] (Appeared in the Financial Post) by Jake Fuss and Grady Munro

Across all income groups, 61 per cent of Canadian families faced higher income taxes than they did in 2015.

Christy Clark’s mixed record as B.C. premier includes higher taxes [[link removed]] by Jason Clemens, Tegan Hill and Milagros Palacios

Due to changes under Clark, the province’s carbon tax effectively became a tax increase.

The problem with deficits and debt [[link removed]] by Tegan Hill and Jake Fuss

The federal government’s total debt will reach a projected $2.2 trillion this fiscal year.

Sales tax promise good news for Nova Scotia but province needs broader tax reform [[link removed]] by Ben Eisen

Nova Scotia has the second-highest top combined personal income tax rate in Canada and the United States.

Toronto property tax hikes—a brief history [[link removed]] by Livio Di Matteo

Over 25 years, Toronto’s municipal tax levy increase exceeded the inflation rate 17 times.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Canada’s Waning Competitiveness on Capital Gains Taxes is a new study that finds by increasing the capital gains inclusion rate, the federal government has made Canada less competitive compared to other advanced countries. At the previous 50 per cent inclusion rate, Canada’s top capital gains tax rate ranked between 17th and 23rd (depending on the province) out of 37 high-income developed countries in the Organisation for Economic Co-operation and Development (OECD). Raising the inclusion rate to 66.7 per cent means Canada’s top capital gains tax rate would be between 8th and 13th highest, depending on the province.

Read More [[link removed]] Federal government should prioritize immigrants with STEM qualifications and language skills [[link removed]]

Insights To Guide Immigration Policy finds that to help increase living standards for Canadians, the federal government should reform its immigration system and prioritize immigrants with STEM (science, technology, engineering and mathematics) qualifications and strong English or French language skills.

Read More [[link removed]] Commentary and Blog Posts Trump’s oil tariffs could spell deficits for Alberta government [[link removed]] (Appeared in the Calgary Sun) by Tegan Hill

The provincial government will spend a projected $1,603 more per Albertan this year than it originally planned.

Our energy policies have made us more vulnerable to Trump’s tariffs [[link removed]] (Appeared in the Calgary Herald) by Elmira Aliakbari and Jason Clemens

Canada currently has no operational infrastructure for exporting liquified natural gas.

Property tax hike would make Toronto even less attractive to top talent [[link removed]] (Appeared in the Toronto Sun) by Ben Eisen

In neighbouring Michigan, the top personal income tax rate is more than 12 percentage points lower than in Ontario.

We need our own ‘DOGE’ in 2025 to unleash Canadian economy [[link removed]] (Appeared in the Financial Post) by Kenneth P. Green

Since 2015, the Trudeau government has enacted a swath of new regulations on large sectors of Canada’s economy.

Trudeau’s legacy includes larger tax burden for middle-class Canadians [[link removed]] (Appeared in the Financial Post) by Jake Fuss and Grady Munro

Across all income groups, 61 per cent of Canadian families faced higher income taxes than they did in 2015.

Christy Clark’s mixed record as B.C. premier includes higher taxes [[link removed]] by Jason Clemens, Tegan Hill and Milagros Palacios

Due to changes under Clark, the province’s carbon tax effectively became a tax increase.

The problem with deficits and debt [[link removed]] by Tegan Hill and Jake Fuss

The federal government’s total debt will reach a projected $2.2 trillion this fiscal year.

Sales tax promise good news for Nova Scotia but province needs broader tax reform [[link removed]] by Ben Eisen

Nova Scotia has the second-highest top combined personal income tax rate in Canada and the United States.

Toronto property tax hikes—a brief history [[link removed]] by Livio Di Matteo

Over 25 years, Toronto’s municipal tax levy increase exceeded the inflation rate 17 times.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor