| From | IPA Financial Inclusion Program <[email protected]> |

| Subject | IPA Consumer Protection Quarterly | Issue 4: September 2021 |

| Date | September 30, 2021 4:34 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

The newest edition of our consumer protection newsletter.

View this email in your browser

[link removed]

[link removed]

More evidence, less poverty

IPA Consumer Protection Quarterly

Issue No. 4 – September 2021

Welcome back to the Consumer Protection Quarterly, IPA's newsletter on the latest consumer protection research across the globe. This newsletter is part of IPA's Consumer Protection Research Initiative

[link removed]

. Each quarter we send you the latest research, insights, and inspiration for financial consumer protection. If you have something to share, please reach out: [email protected]

mailto:[email protected]?subject=Consumer%20Protection%20Quarterly

.

You are receiving this email because of your past participation in IPA consumer protection or financial inclusion events, and/or because you signed up for our consumer protection practitioner's forum mailing interest list

[link removed]

. If there are others you think may benefit from this newsletter, please forward. You can manage your email preferences here

[link removed]

.

What's new and what's next

New: Digital credit impact evaluations and donor funding

In September, Blumenstock, Bjorkegren and Nair shared results from their study “Welfare Impacts of Digital Credit: Results from a Randomized Evaluation in Nigeria.”

[link removed]

(IPA is funding a second phase of this research to build welfare-sensitive credit scores) This is the third impact evaluation of digital credit in the financial inclusion space (see Suri, et al.

[link removed]

and Brailovskaya, et al.

[link removed]

). The generally positive but relatively modest impacts these digital credit impact evaluations find raised some questions for our teammate Rafe Mazer on the role of donors in supporting digital credit, which he shares in our latest blog

[link removed]

. We would love to hear your reactions to the digital credit studies and the points Rafe raises.

Next: Leveraging machine learning to detect fraudulent FinTech apps (webinar on October 20th

[link removed]

)

[link removed]

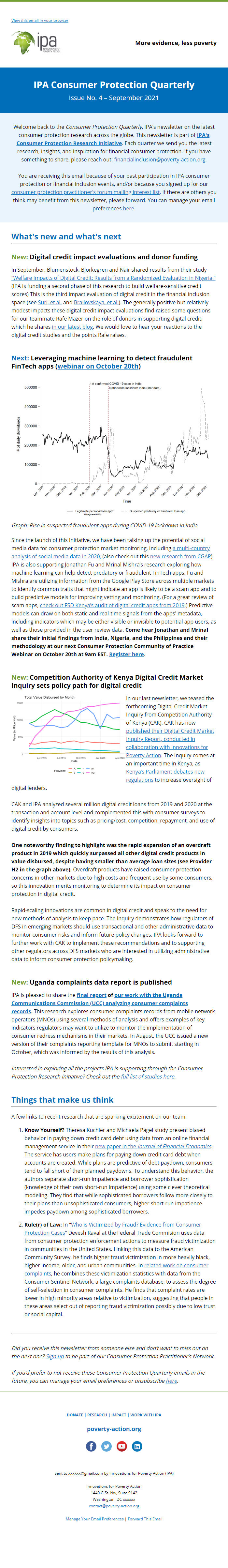

Graph: Rise in suspected fraudulent apps during COVID-19 lockdown in India

Since the launch of this Initiative, we have been talking up the potential of social media data for consumer protection market monitoring, including a multi-country analysis of social media data in 2020

[link removed]

, (also check out this new research from CGAP

[link removed]

). IPA is also supporting Jonathan Fu and Mrinal Mishra’s research exploring how machine learning can help detect predatory or fraudulent FinTech apps. Fu and Mishra are utilizing information from the Google Play Store across multiple markets to identify common traits that might indicate an app is likely to be a scam app and to build predictive models for improving vetting and monitoring. (For a great review of scam apps, check out FSD Kenya’s audit of digital credit apps from 2019

[link removed]

.) Predictive models can draw on both static and real-time signals from the apps' metadata, including indicators which may be either visible or invisible to potential app users, as well as those provided in the user review data. Come hear Jonathan and Mrinal share their initial findings from India, Nigeria, and the Philippines and their methodology at our next Consumer Protection Community of Practice Webinar on October 20th at 9am EST. Register here

[link removed]

.

New: Competition Authority of Kenya Digital Credit Market Inquiry sets policy path for digital credit

[link removed]

In our last newsletter, we teased the forthcoming Digital Credit Market Inquiry from Competition Authority of Kenya (CAK). CAK has now published their Digital Credit Market Inquiry Report, conducted in collaboration with Innovations for Poverty Action

[link removed]

. The Inquiry comes at an important time in Kenya, as Kenya’s Parliament debates new regulations

[link removed]

to increase oversight of digital lenders.

CAK and IPA analyzed several million digital credit loans from 2019 and 2020 at the transaction and account level and complemented this with consumer surveys to identify insights into topics such as pricing/cost, competition, repayment, and use of digital credit by consumers.

One noteworthy finding to highlight was the rapid expansion of an overdraft product in 2019 which quickly surpassed all other digital credit products in value disbursed, despite having smaller than average loan sizes (see Provider H2 in the graph above). Overdraft products have raised consumer protection concerns in other markets due to high costs and frequent use by some consumers, so this innovation merits monitoring to determine its impact on consumer protection in digital credit.

Rapid-scaling innovations are common in digital credit and speak to the need for new methods of analysis to keep pace. The Inquiry demonstrates how regulators of DFS in emerging markets should use transactional and other administrative data to monitor consumer risks and inform future policy changes. IPA looks forward to further work with CAK to implement these recommendations and to supporting other regulators across DFS markets who are interested in utilizing administrative data to inform consumer protection policymaking.

New: Uganda complaints data report is published

IPA is pleased to share the final report

[link removed]

of our work with the Uganda Communications Commission (UCC) analyzing consumer complaints records

[link removed]

. This research explores consumer complaints records from mobile network operators (MNOs) using several methods of analysis and offers examples of key indicators regulators may want to utilize to monitor the implementation of consumer redress mechanisms in their markets. In August, the UCC issued a new version of their complaints reporting template for MNOs to submit starting in October, which was informed by the results of this analysis.

Interested in exploring all the projects IPA is supporting through the Consumer Protection Research Initiative? Check out the full list of studies here

[link removed]

.

Things that make us think

A few links to recent research that are sparking excitement on our team:

Know Yourself? Theresa Kuchler and Michaela Pagel study present biased behavior in paying down credit card debt using data from an online financial management service in their new paper in the Journal of Financial Economics

[link removed]

. The service has users make plans for paying down credit card debt when accounts are created. While plans are predictive of debt paydown, consumers tend to fall short of their planned paydowns. To understand this behavior, the authors separate short-run impatience and borrower sophistication (knowledge of their own short-run impatience) using some clever theoretical modeling. They find that while sophisticated borrowers follow more closely to their plans than unsophisticated consumers, higher short-run impatience impedes paydown among sophisticated borrowers.

Rule(r) of Law: In “Who is Victimized by Fraud? Evidence from Consumer Protection Cases

[link removed]

” Devesh Raval at the Federal Trade Commision uses data from consumer protection enforcement actions to measure fraud victimization in communities in the United States. Linking this data to the American Community Survey, he finds higher fraud victimization in more heavily black, higher income, older, and urban communities. In related work on consumer complaints

[link removed]

, he combines these victimization statistics with data from the Consumer Sentinel Network, a large complaints database, to assess the degree of self-selection in consumer complaints. He finds that complaint rates are lower in high minority areas relative to victimization, suggesting that people in these areas select out of reporting fraud victimization possibly due to low trust or social capital.

Did you receive this newsletter from someone else and don’t want to miss out on the next one? Sign up

[link removed]

to be part of our Consumer Protection Practitioner’s Network.

If you’d prefer to not receive these Consumer Protection Quarterly emails in the future, you can manage your email preferences or unsubscribe here

[link removed]

.

DONATE

[link removed]

| RESEARCH

[link removed]

| IMPACT

[link removed]

| WORK WITH IPA

[link removed]

poverty-action.org

[link removed]

[link removed]

[link removed]

[link removed]

[link removed]

Sent to [email protected] by Innovations for Poverty Action (IPA)

Innovations for Poverty Action

1440 G St. Nw, Suite 9142

Washington, DC xxxxxx

[email protected]

mailto:[email protected]

Manage Your Email Preferences

[link removed]

| Forward This Email

[link removed]

View this email in your browser

[link removed]

[link removed]

More evidence, less poverty

IPA Consumer Protection Quarterly

Issue No. 4 – September 2021

Welcome back to the Consumer Protection Quarterly, IPA's newsletter on the latest consumer protection research across the globe. This newsletter is part of IPA's Consumer Protection Research Initiative

[link removed]

. Each quarter we send you the latest research, insights, and inspiration for financial consumer protection. If you have something to share, please reach out: [email protected]

mailto:[email protected]?subject=Consumer%20Protection%20Quarterly

.

You are receiving this email because of your past participation in IPA consumer protection or financial inclusion events, and/or because you signed up for our consumer protection practitioner's forum mailing interest list

[link removed]

. If there are others you think may benefit from this newsletter, please forward. You can manage your email preferences here

[link removed]

.

What's new and what's next

New: Digital credit impact evaluations and donor funding

In September, Blumenstock, Bjorkegren and Nair shared results from their study “Welfare Impacts of Digital Credit: Results from a Randomized Evaluation in Nigeria.”

[link removed]

(IPA is funding a second phase of this research to build welfare-sensitive credit scores) This is the third impact evaluation of digital credit in the financial inclusion space (see Suri, et al.

[link removed]

and Brailovskaya, et al.

[link removed]

). The generally positive but relatively modest impacts these digital credit impact evaluations find raised some questions for our teammate Rafe Mazer on the role of donors in supporting digital credit, which he shares in our latest blog

[link removed]

. We would love to hear your reactions to the digital credit studies and the points Rafe raises.

Next: Leveraging machine learning to detect fraudulent FinTech apps (webinar on October 20th

[link removed]

)

[link removed]

Graph: Rise in suspected fraudulent apps during COVID-19 lockdown in India

Since the launch of this Initiative, we have been talking up the potential of social media data for consumer protection market monitoring, including a multi-country analysis of social media data in 2020

[link removed]

, (also check out this new research from CGAP

[link removed]

). IPA is also supporting Jonathan Fu and Mrinal Mishra’s research exploring how machine learning can help detect predatory or fraudulent FinTech apps. Fu and Mishra are utilizing information from the Google Play Store across multiple markets to identify common traits that might indicate an app is likely to be a scam app and to build predictive models for improving vetting and monitoring. (For a great review of scam apps, check out FSD Kenya’s audit of digital credit apps from 2019

[link removed]

.) Predictive models can draw on both static and real-time signals from the apps' metadata, including indicators which may be either visible or invisible to potential app users, as well as those provided in the user review data. Come hear Jonathan and Mrinal share their initial findings from India, Nigeria, and the Philippines and their methodology at our next Consumer Protection Community of Practice Webinar on October 20th at 9am EST. Register here

[link removed]

.

New: Competition Authority of Kenya Digital Credit Market Inquiry sets policy path for digital credit

[link removed]

In our last newsletter, we teased the forthcoming Digital Credit Market Inquiry from Competition Authority of Kenya (CAK). CAK has now published their Digital Credit Market Inquiry Report, conducted in collaboration with Innovations for Poverty Action

[link removed]

. The Inquiry comes at an important time in Kenya, as Kenya’s Parliament debates new regulations

[link removed]

to increase oversight of digital lenders.

CAK and IPA analyzed several million digital credit loans from 2019 and 2020 at the transaction and account level and complemented this with consumer surveys to identify insights into topics such as pricing/cost, competition, repayment, and use of digital credit by consumers.

One noteworthy finding to highlight was the rapid expansion of an overdraft product in 2019 which quickly surpassed all other digital credit products in value disbursed, despite having smaller than average loan sizes (see Provider H2 in the graph above). Overdraft products have raised consumer protection concerns in other markets due to high costs and frequent use by some consumers, so this innovation merits monitoring to determine its impact on consumer protection in digital credit.

Rapid-scaling innovations are common in digital credit and speak to the need for new methods of analysis to keep pace. The Inquiry demonstrates how regulators of DFS in emerging markets should use transactional and other administrative data to monitor consumer risks and inform future policy changes. IPA looks forward to further work with CAK to implement these recommendations and to supporting other regulators across DFS markets who are interested in utilizing administrative data to inform consumer protection policymaking.

New: Uganda complaints data report is published

IPA is pleased to share the final report

[link removed]

of our work with the Uganda Communications Commission (UCC) analyzing consumer complaints records

[link removed]

. This research explores consumer complaints records from mobile network operators (MNOs) using several methods of analysis and offers examples of key indicators regulators may want to utilize to monitor the implementation of consumer redress mechanisms in their markets. In August, the UCC issued a new version of their complaints reporting template for MNOs to submit starting in October, which was informed by the results of this analysis.

Interested in exploring all the projects IPA is supporting through the Consumer Protection Research Initiative? Check out the full list of studies here

[link removed]

.

Things that make us think

A few links to recent research that are sparking excitement on our team:

Know Yourself? Theresa Kuchler and Michaela Pagel study present biased behavior in paying down credit card debt using data from an online financial management service in their new paper in the Journal of Financial Economics

[link removed]

. The service has users make plans for paying down credit card debt when accounts are created. While plans are predictive of debt paydown, consumers tend to fall short of their planned paydowns. To understand this behavior, the authors separate short-run impatience and borrower sophistication (knowledge of their own short-run impatience) using some clever theoretical modeling. They find that while sophisticated borrowers follow more closely to their plans than unsophisticated consumers, higher short-run impatience impedes paydown among sophisticated borrowers.

Rule(r) of Law: In “Who is Victimized by Fraud? Evidence from Consumer Protection Cases

[link removed]

” Devesh Raval at the Federal Trade Commision uses data from consumer protection enforcement actions to measure fraud victimization in communities in the United States. Linking this data to the American Community Survey, he finds higher fraud victimization in more heavily black, higher income, older, and urban communities. In related work on consumer complaints

[link removed]

, he combines these victimization statistics with data from the Consumer Sentinel Network, a large complaints database, to assess the degree of self-selection in consumer complaints. He finds that complaint rates are lower in high minority areas relative to victimization, suggesting that people in these areas select out of reporting fraud victimization possibly due to low trust or social capital.

Did you receive this newsletter from someone else and don’t want to miss out on the next one? Sign up

[link removed]

to be part of our Consumer Protection Practitioner’s Network.

If you’d prefer to not receive these Consumer Protection Quarterly emails in the future, you can manage your email preferences or unsubscribe here

[link removed]

.

DONATE

[link removed]

| RESEARCH

[link removed]

| IMPACT

[link removed]

| WORK WITH IPA

[link removed]

poverty-action.org

[link removed]

[link removed]

[link removed]

[link removed]

[link removed]

Sent to [email protected] by Innovations for Poverty Action (IPA)

Innovations for Poverty Action

1440 G St. Nw, Suite 9142

Washington, DC xxxxxx

[email protected]

mailto:[email protected]

Manage Your Email Preferences

[link removed]

| Forward This Email

[link removed]

Message Analysis

- Sender: Poverty Action

- Political Party: n/a

- Country: United States

- State/Locality: Washington

- Office: n/a

-

Email Providers:

- Pardot

- Litmus