| From | Minnesota Department of Revenue <[email protected]> |

| Subject | Tax Professional Tip #3 – Renters No Longer File Form M1PR |

| Date | January 16, 2025 3:34 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Tax professionals

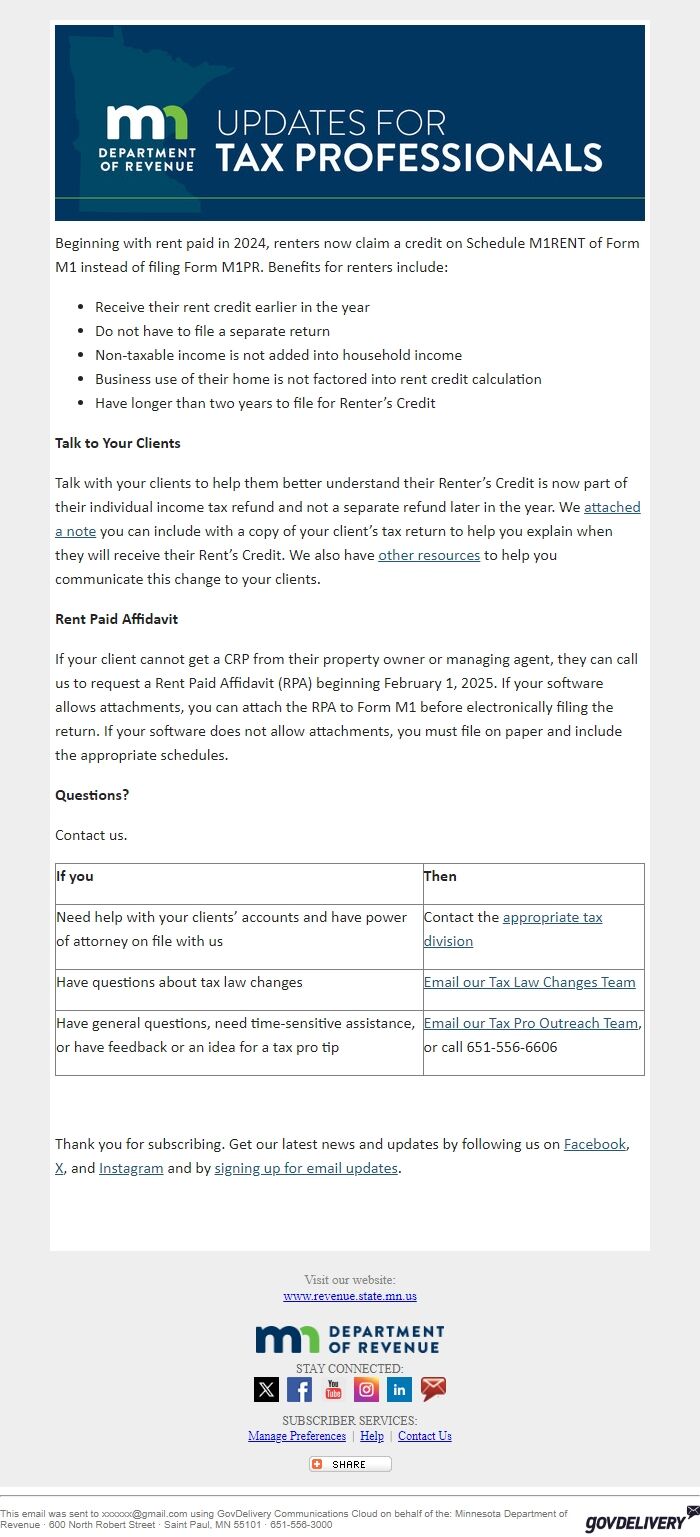

Beginning with rent paid in 2024, renters now claim a credit on Schedule M1RENT of Form M1 instead of filing Form M1PR. Benefits for renters include:

* Receive their rent credit earlier in the year

* Do not have to file a separate return

* Non-taxable income is not added into household income

* Business use of their home is not factored into rent credit calculation

* Have longer than two years to file for Renter’s Credit

*Talk to Your Clients*

Talk with your clients to help them better understand their Renter’s Credit is now part of their individual income tax refund and not a separate refund later in the year. We attached a note [ [link removed] ] you can include with a copy of your client’s tax return to help you explain when they will receive their Rent’s Credit. We also have other resources [ [link removed] ] to help you communicate this change to your clients.

*Rent Paid Affidavit*

If your client cannot get a CRP from their property owner or managing agent, they can call us to request a Rent Paid Affidavit (RPA) beginning February 1, 2025. If your software allows attachments, you can attach the RPA to Form M1 before electronically filing the return. If your software does not allow attachments, you must file on paper and include the appropriate schedules.

*Questions?*

Contact us.

*If you*

*Then*

Need help with your clients’ accounts and have power of attorney on file with us

Contact the appropriate tax division [ [link removed] ]

Have questions about tax law changes

Email our Tax Law Changes Team <[email protected]>

Have general questions, need time-sensitive assistance, or have feedback or an idea for a tax pro tip

Email our Tax Pro Outreach Team <[email protected]>, or call 651-556-6606

Thank you for subscribing. Get our latest news and updates by following us on Facebook [ [link removed] ], X [ [link removed] ], and Instagram [ [link removed] ] and by signing up for email updates [ [link removed] ].

* *

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Instagram [ [link removed] ] LinkedIn [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ] | Help [ [link removed] ] | Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue · 600 North Robert Street · Saint Paul, MN 55101 · 651-556-3000 GovDelivery logo [ [link removed] ]

Beginning with rent paid in 2024, renters now claim a credit on Schedule M1RENT of Form M1 instead of filing Form M1PR. Benefits for renters include:

* Receive their rent credit earlier in the year

* Do not have to file a separate return

* Non-taxable income is not added into household income

* Business use of their home is not factored into rent credit calculation

* Have longer than two years to file for Renter’s Credit

*Talk to Your Clients*

Talk with your clients to help them better understand their Renter’s Credit is now part of their individual income tax refund and not a separate refund later in the year. We attached a note [ [link removed] ] you can include with a copy of your client’s tax return to help you explain when they will receive their Rent’s Credit. We also have other resources [ [link removed] ] to help you communicate this change to your clients.

*Rent Paid Affidavit*

If your client cannot get a CRP from their property owner or managing agent, they can call us to request a Rent Paid Affidavit (RPA) beginning February 1, 2025. If your software allows attachments, you can attach the RPA to Form M1 before electronically filing the return. If your software does not allow attachments, you must file on paper and include the appropriate schedules.

*Questions?*

Contact us.

*If you*

*Then*

Need help with your clients’ accounts and have power of attorney on file with us

Contact the appropriate tax division [ [link removed] ]

Have questions about tax law changes

Email our Tax Law Changes Team <[email protected]>

Have general questions, need time-sensitive assistance, or have feedback or an idea for a tax pro tip

Email our Tax Pro Outreach Team <[email protected]>, or call 651-556-6606

Thank you for subscribing. Get our latest news and updates by following us on Facebook [ [link removed] ], X [ [link removed] ], and Instagram [ [link removed] ] and by signing up for email updates [ [link removed] ].

* *

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Instagram [ [link removed] ] LinkedIn [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ] | Help [ [link removed] ] | Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue · 600 North Robert Street · Saint Paul, MN 55101 · 651-556-3000 GovDelivery logo [ [link removed] ]

Message Analysis

- Sender: Minnesota Department of Revenue

- Political Party: n/a

- Country: United States

- State/Locality: Minnesota

- Office: n/a

-

Email Providers:

- govDelivery